Understanding the Sensex: India’s Iconic Stock Market Index

- Details

The S&P BSE Sensex, commonly referred to as the Sensex, is India's most recognized and widely followed stock market index. Launched in 1986 by the Bombay Stock Exchange (BSE), it serves as a barometer of the Indian equity market's health, tracking the performance of the top 30 financially sound and well-established companies listed on the BSE.

The Sensex, or the Bombay Stock Exchange Sensitive Index, was launched on January 2, 1986. The base year for the Sensex is 1979, with a base value of 100 points.

The difference between the base year and the launch year is 7 years. The base year is used as a reference point to measure the index’s performance over time, while the launch year marks the beginning of the Sensex’s official tracking and publication.

What is the Sensex?

The Sensex, derived from the words "Sensitive Index," is designed to reflect the performance of India's large, financially robust companies. It tracks the movement of 30 of the largest and most actively traded stocks listed on the BSE, representing key sectors of the Indian economy. These companies are selected based on free-float market capitalization, liquidity, and other relevant factors.

How is the Sensex Calculated?

The Sensex is calculated using the free-float market capitalization method. This method considers only the portion of a company’s shares available for trading by the public, excluding shares held by promoters, government, or other locked-in shareholders.

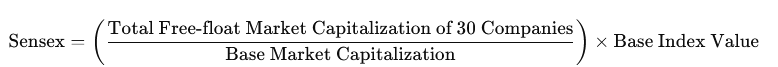

Formula for Sensex Calculation:

Here’s a breakdown:

-

Free-Float Market Capitalization: This is the market value of the shares that are readily available for trading. It excludes promoter holdings, government holdings, and other locked-in shares.

-

Base Market Capitalization: This is the market capitalization of the index during the base year, which is 1979.

-

Base Value: The base value of the Sensex is 100.

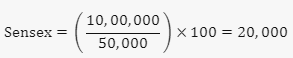

Example Calculation:

If the total free-float market capitalization of the 30 companies in the Sensex is ₹10,00,000 crore and the base market capitalization is ₹50,000 crore, the Sensex value would be:

Sensex Composition: The Top 30 Stocks

The Sensex includes 30 companies from various sectors, ensuring a balanced and diversified portfolio that mirrors the broader economy. The index is reviewed regularly to ensure it remains reflective of the market’s top performers.

Here’s a look at some of the major companies included in the Sensex as of 2024:

| Company Name | Sector | Free-Float Market Cap Weight |

| Reliance Industries | Oil & Gas | ~11.94% |

| Tata Consultancy Services (TCS) | IT Services | ~9.14% |

| HDFC Bank | Banking & Financial | ~8.01% |

| Bharti Airtel | Telecom | ~6.23% |

| ICICI Bank | Banking & Financial | ~5.51% |

| Infosys | IT Services | ~4.65% |

| State Bank of India (SBI) | Banking & Financial | ~4.18% |

| Hindustan Unilever | Consumer Goods | ~4.09% |

| Larsen & Toubro (L&T) | Infrastructure | ~3.08% |

| Kotak Mahindra Bank | Banking & Financial | ~2.22% |

These companies, across sectors like financial services, IT, energy, consumer goods, and telecom, contribute to the index’s overall movement. Their performance affects not just the Sensex but also provides insights into broader economic trends.

Significance of the Sensex

- Market Sentiment Indicator: The Sensex provides a snapshot of the overall health of the Indian stock market. Rising Sensex values generally indicate positive market sentiment, while a declining Sensex often signals bearish trends.

- Benchmark for Mutual Funds and ETFs: Many mutual funds and exchange-traded funds (ETFs) use the Sensex as a benchmark to assess their performance. Investors often compare their portfolios with the Sensex to evaluate whether they are outperforming or underperforming the market.

- Investor Confidence: A rising Sensex often boosts investor confidence, attracting more retail and institutional investments. Conversely, a falling Sensex may cause investors to be cautious, leading to a pullback from the market.

- Economic Indicator:As the Sensex represents a broad range of industries, it acts as a barometer for the Indian economy. Economists, analysts, and even policymakers track the Sensex to get insights into economic performance and investor confidence.

Factors That Influence the Sensex

- Corporate Earnings: The financial performance of the top 30 companies plays a crucial role in determining the direction of the Sensex. Strong earnings reports typically push the Sensex higher, while disappointing results may cause it to decline.

- Global Economic Trends: India is part of the global economy, and events such as international trade policies, geopolitical tensions, and global recessions can impact investor sentiment, leading to volatility in the Sensex.

- Government Policies: Economic reforms, interest rates, inflation rates, and fiscal policies significantly affect investor confidence. Pro-business policies often lead to a surge in the Sensex, while unfavourable policies may dampen growth.

- Foreign Institutional Investments (FII): The movement of foreign funds into or out of Indian markets is a major factor influencing the Sensex. High inflows from FIIs typically push the Sensex up, while large outflows can bring it down.

Conclusion

The Sensex is not just a stock market index; it is a reflection of India’s economic growth and development over time. Its importance to investors, fund managers, policymakers, and even the common man is undeniable. By tracking the top 30 companies, the Sensex provides a reliable indicator of market trends, helping investors make informed decisions.

If you’re considering investing in India or want to grasp the market dynamics, tracking the Sensex is essential. By monitoring its movements, you can gain insights into market trends and make informed investment decisions. Whether you’re a novice or an experienced investor, understanding the Sensex can guide you through the market’s fluctuations and help you strategize effectively.

Read more on: www.adroitfinancial.com