Midcap vs Smallcap in India: Unlocking Growth Opportunities in 2025

- Details

Looking to grow your wealth faster than large-cap stocks usually allow?

Then you need to understand India’s midcap and smallcap indices, they're where the real growth stories begin.

In 2025, with India’s economy expanding and market participation rising, these segments are becoming a hotbed of opportunity (and risk!). Let’s break it down so you can invest smarter.

What Are Midcap and Smallcap Indices?

In simple terms, companies are classified based on their market capitalization (market value):

- Large Cap: Top 100 companies

- Mid Cap: Ranked 101–250 (bigger than small, smaller than large)

- Small Cap: Ranked 251 onwards (high growth, high risk)

Indices are groups of such stocks. For example:

- Nifty Midcap 150

- Nifty Smallcap 250

They track how these segments are performing in the market.

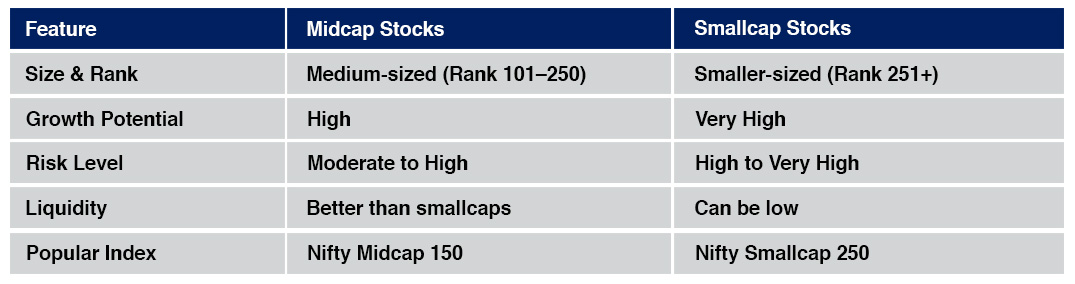

Midcap vs Smallcap: What's the Difference?

Midcaps are like rising stars.

Smallcaps are like start-ups with big dreams.

Why 2025 Is a Big Year for Mid & Small Caps?

India’s mid and small cap segments are booming in 2025 due to:

- Make in India + Capex Boom: Manufacturing and infrastructure sectors are getting a boost.

- Retail investor surge: More people are willing to take calculated risks.

- Tech & Digital expansion: Many small IT and digital companies are scaling up.

- Large cap underperformance: Investors are shifting to faster-growing segments.

Some midcaps are now transitioning into future large caps, invest early, and you might ride that wave.

Who Should Consider Investing?

Mid and smallcap stocks aren’t for everyone, but if you’re:

- A young investor with time on your side

- Seeking higher-than-average growth

- Okay with short-term volatility

- Ready to research or use index funds

Then this segment could be your growth engine.

How to Tap Into This Opportunity?

- Here are some smart ways to invest in midcap and smallcap indices:

-

Index Funds/ETFs

-

E.g., Nifty Midcap 150 ETF, Smallcap 250 Index Fund

-

Good for passive investors

-

-

Actively Managed Mutual Funds

-

Choose well-rated funds with experienced managers

-

-

Direct Stock Picks (Only if you research well)

-

Focus on debt-free, profitable companies with growth potential

-

Pro Tip: Always diversify. Don’t put all your money in one segment.

-

Things to Keep in Mind

- 📉 Volatility: These stocks can swing wildly in the short term

- Patience: Returns take time, think 3–5 years minimum

- Do Your Homework: Mid and small caps need more research

- Don’t chase past performance

Final Thoughts: Small Size, Big Potential

Midcap and smallcap indices represent the entrepreneurial spirit of India’s market. Yes, they carry risk, but also the power to multiply wealth when approached wisely.

“The next Infosys or Titan might just be hiding in the smallcap space today.”

So, stay curious, stay informed, and make 2025 your smartest investing year yet.

Read more on: www.adroitfinancial.com