Fundamental Analysis: Principles, Types, and How to Use It

- Details

Why Fundamental Analysis Matters

Fundamental analysis is an approach to evaluating the intrinsic value of a company by analyzing its financials and broader economic environment, aiming to determine whether a stock is underpriced or overpriced. It focuses on the company’s real business fundamentals rather than fleeting price trends, guiding long-term, value-based investing decisions.

Core Principles

-

Intrinsic Value vs. Market Price

Assess if the stock is under or overvalued based on the company's true worth, not just market swings. This aligns with emphasis on investment judgment grounded in valuation. -

Long-Term Perspective

Fundamental analysis supports long-term portfolio strategies over short-term speculation. -

Business Over Charts

Instead of chasing tickers, this method prioritizes business quality, competitive positioning, and management effectiveness, core elements emphasized within equity investments and financial reporting.

Types of Fundamental Analysis

- Quantitative Analysis

Involves hard metrics like revenue, margins, debt, and valuation multiples. It’s the backbone for calculating investment-worthy figures such as intrinsic value. - Qualitative Analysis

Focuses on aspects like brand reputation, leadership, competitive edge, and industry dynamics, all central to analyzing long-term business potential.

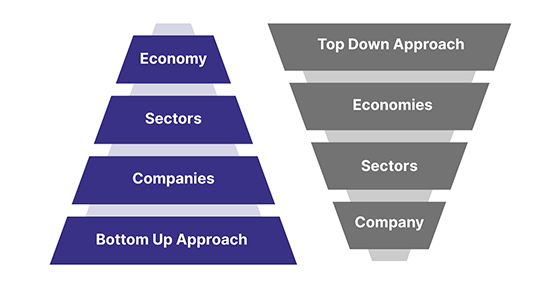

Types of Fundamental Approach

- Top-Down Approach

This approach begins with a broad view of the economy and works its way down to individual companies. Start by examining the macroeconomic environment, such as GDP growth, interest rates, inflation, and industry performance. After assessing the economy's overall health, they narrow down to sectors and industries, ultimately analyzing individual companies.

- Bottom-Up Approach

In contrast to the top-down approach, bottom-up analysis focuses on individual companies. Evaluate the company's fundamentals, including earnings, management quality, and competitive position, irrespective of broader market trends. This approach is often favoured by stock-pickers who want to identify undervalued gems in any market condition.

How to Use Fundamental Analysis

Step-by-Step Guide:

-

Start Broad: Consider macroeconomic indicators such as GDP growth, interest rates, and inflation to set context.

-

Industry Insight: Understand sector trends, regulatory impact, and peer comparisons.

-

Business-Level Evaluation: Assess the business model, strategic direction, and executive leadership.

-

Deep Financial Analysis: Examine revenues, cash flows, liabilities, and earnings through statements.

-

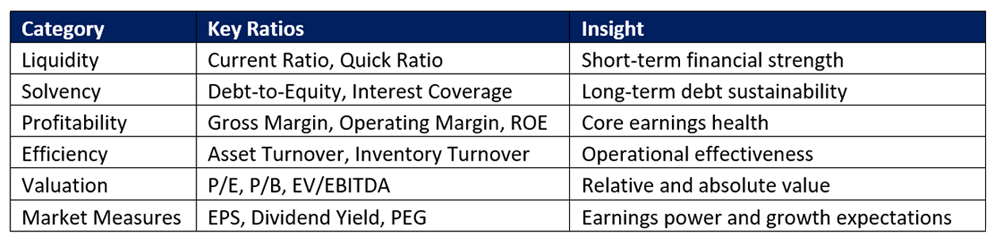

Ratio Analysis: Apply key ratios (see table below) for insight into liquidity, profitability, and valuation.

-

Valuation Check: Determine if the stock is priced below intrinsic value using multiples or DCF models.

-

Decision: Combine both data and qualitative assessments to make your investment choice.

Ratios Every Investor Should Track

Always benchmark these metrics against industry peers and past performance for context.

Final Thoughts

Fundamental analysis empowers you to invest thoughtfully, focusing on a company’s real worth instead of short-term hype. Combine both quantitative and qualitative variables, use the right ratios, and benchmark results for smarter investment decisions.

Dive deeper into financial statements, test the ratios over time, and blend your analysis with a margin of safety to lower investment risk.

Read more on: www.adroitfinancial.com